Introduction

Mistakes on your credit report may very well negatively reflect on your financial life. Mistakes lower your credit score, increase interest rates, and in some cases, deny loans and even credit cards. As we go into 2024, it is always wise to make sure that your credit report is error-free and accurate. It is with this in mind that we present you with this comprehensive guide detailing exactly how you can identify, dispute, and correct credit report errors. By following these strategies, you will be well on your way to saving your financial reputation and improving your credit score.

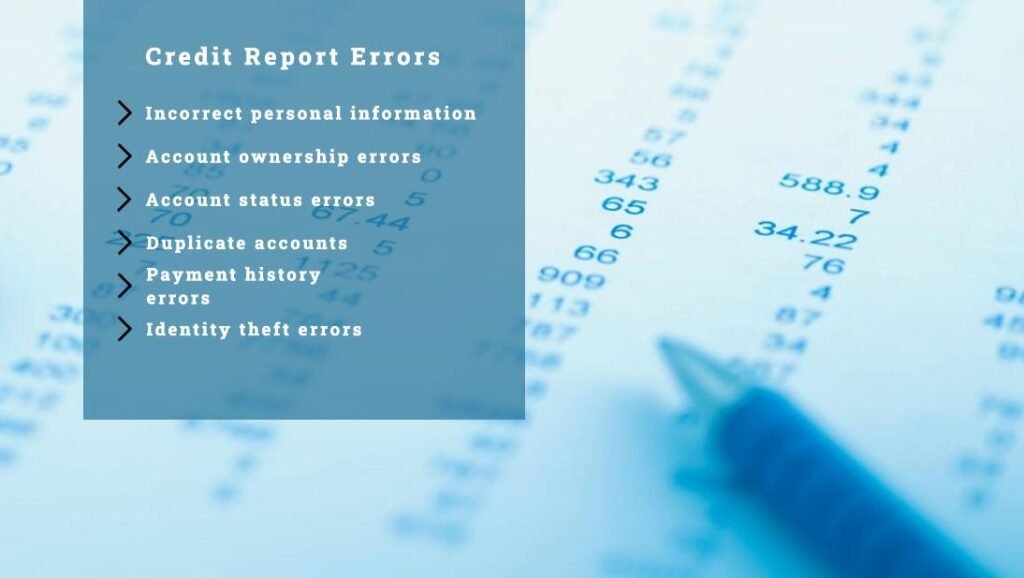

Understanding Credit Report Errors

What Are Credit Report Errors?

Credit report errors can be defined as inaccurate or mistaken information in your credit report. There may be mistakes in the personal information section or under the account information section or even fraudulent accounts. Some of the most common types of errors include:

• Incorrect personal information: In this category fall mistakes made against your name, address, Social Security number, date of birth,.

• Account ownership errors: Accounts that do not belong to you.

• Account status errors: Accounts closed and it is still showing open; incorrect credit limit or balance.

• Duplicate accounts: Having the same account more than once.

• Payment history errors: Late or missed payments reported as such.

• Identity theft errors: Someone opening fraudulent accounts in your name.

Why You Should Correct Your Errors

Mistakes on your credit report may have a huge effect on your financial livelihood. They lower your credit score, thus causing one to fail in securing loans or any credit card facility. Besides, inaccuracies also cause an interest rise, greater premiums on insurance, and job rejections. Correcting such errors on time will greatly help to improve your credit score and ensure you’re treated fairly by lenders.

Table 1: Common Types of Credit Report Errors

| Type of Error | Description |

| Personal Information Errors | Incorrect name, address, Social Security number |

| Account Ownership Errors | Accounts that do not belong to you |

| Account Status Errors | Incorrect account status, such as closed accounts reported as open |

| Duplicate Accounts | Same account reported multiple times |

| Payment History Errors | Inaccurate payment records, such as late payments reported as on-time |

| Identity Theft Errors | Fraudulent accounts opened in your name |

How Credit Report Mistakes Happen

There are many ways credit report mistakes can happen:

1. Data Entry Mistakes: Simple human errors in entering your data can pop up as incorrect information reported.

2. Mixed Files: Your credit file may get mixed up with that of another individual with the same name or Social Security number.

3. Identity Theft: A scammer opening accounts using your name will make sure that incorrect information is present on your credit report.

4. Human error: Wrong information regarding the account may be provided to the credit bureaus by the creditors or lenders.

5. Outdated information: Information from a really long time ago is not updated on time. Hence it becomes inaccurate. This knowledge of the reasons for the errors could be helpful in making you more aware when checking your credit report.

Step-by-Step Guide to Disputing Credit Report Errors

Step 1: Get hold of Your Credit Reports

First, obtain your credit report from the three large credit bureaus: Equifax, Experian, and TransUnion. You are entitled to one free report from each once every 12 months through AnnualCreditReport.com.

Step 2: Carefully Review Your Credit Reports

Once you have obtained your credit reports, read them very carefully for any errors. Pay special attention to the following areas:

• Personal Information: Your name, address, and Social Security number should be accurate.

• Account Information: All accounts listed should be yours, and their status should be accurate.

• Inquiry: Check for unauthorized inquiries; this could be a sign of identity theft.

Table 2: Key Sections to Review in Your Credit Report

| Section | What to Check For |

| Personal Information | Correct name, address, and Social Security number |

| Account Information | Verify account ownership, status, and payment history |

| Inquiries | Look for unauthorized or unfamiliar inquiries |

Step 3: Gather Documents to Prove Your Case

Gather all the documents proving your case before you dispute an error. This would include account statements, payment receipts, credit letters, or identity theft reports.

Step 4: Dispute Those Errors

You can dispute errors on your credit report online, by mail, or by phone with the credit bureaus. While the online dispute is faster, mailing it might provide a chance for allowing detailed documentation.

How to Dispute Online

Most of the credit bureaus offer an online dispute facility. These are:

• Equifax: Equifax Online Dispute

• Experian: Experian Online Dispute

• TransUnion: TransUnion Online Dispute

Dispute through Mail

In case you wish to make the dispute through mail, write a letter to the concerned credit bureau while mentioning the following details in your letter:

1. Your Information: Full name, address, date of birth, and Social Security number.

2. Report Details: Mention which error you found in your report.

3. Supporting Documents: Attach the documents related to your dispute.

4. Letter of Dispute: A documented, short letter pointing out the error and correction sought.

Sample Dispute Letter

[Your Name]

[Your Address]

[City, State, ZIP Code]

[Date]

[Credit Bureau Name]

[Credit Bureau Address]

[City, State, ZIP Code]

Re: Dispute of Credit Report Error

Dear [Credit Bureau],

I am writing to dispute the information below, which is reflected in my credit report. Please refer to the attached documents for a better understanding of my case.

• Account Name/Number: [Particulars of incorrect account details]

• Explanation of Error: Brief explanation of the error

I have also included photocopies of the following documents to assist in my dispute:

– [List of supporting documents]

Please investigate this and update the errors on my credit report.

Thank you for your prompt attention regarding this issue.

Sincerely,

[Your Name]

Step 5: Follow Up

After submitting your dispute, ensure the credit bureau investigates your claim. Usually, the bureau takes 30 days to investigate and then respond. Once you get your updated credit report, ensure the error has been corrected.

Common Mistakes to Avoid When Disputing Errors

Insufficient Proof

Dispute any error with maximum possible proof; this would include account statements, payment receipts, and any other type of related documents. The more the proofs presented for a case, the more solid it will turn out to be.

No Follow-Up

Do not just sit back and expect the credit bureau to update the error that you have pointed out. Periodically, follow up to ensure that your dispute status is changed and the proper corrections are effected.

Not Keeping Records

Keep detailed records of all correspondence related to your dispute. That includes copies of your dispute letter and supporting documentation, as well as any responses you may receive from the credit bureau. It’s always helpful to have a paper trail available if you are required to escalate the dispute.

Disputing Online Without Copies

Because arguing over the Internet is easier, it’s also essential to maintain copies of all your submissions. Obtain screen shots or make hard copies of your question submission form and all confirmation messages you receive.

Expecting Immediate Results

Correcting credit report errors can be a time-consuming process. While the credit bureau is required by federal law to investigate your dispute within 30 days, it could be significantly longer before the correct information appears on your credit report. Be patient but persistent.

Stopping Future Mistakes from Appearing on Your Credit Report: Check Your Credit

Monitoring your credit reports can help you catch errors as soon as possible. You can use free credit monitoring services or pay for services, which can also give you identity theft protection benefits.

Freeze Your Credit

A credit freeze on your reports makes sure that no new accounts are created under your name, hence preventing identity theft. You are allowed to freeze your credit for free with each of the three major credit bureaus.

Use Identity Theft Protection Services

You can subscribe to identity theft protection services that monitor your credit and alert you when suspicious activities occur. The services can offer assistance in trying to resolve identity theft.

Protect Personal Information

Be careful about revealing your personal details. Do not give out your Social Security number or any other private information unless absolutely necessary, and make sure that the website is secure before you enter personal information on the Internet.

Keep Your Information Up to Date

Be sure to update your personal information with all creditors and financial institutions, including your address, phone number, and email address. This helps avoid errors and ensures that you’ll receive important notifications.

Consequences of Errors on Credit Reports

Financial Implications

The financial implications of credit report errors may be numerous and include:

•Higher interest rates when taking out a loan or using a credit card: A reduced credit score as a result of errors would lead to high costs of borrowing.

• Credit application refusals: Lenders will deny your credit applications if they see any misinformation.

• Lower credit limits: Such errors may cause them to approve lower credit limits, reducing your borrowing power.

• Higher insurance premiums: Some insurance companies charge higher premiums based on credit information. This can make your insurance cost more as a result of such errors.

• Job application refusals: Some employers also request a credit report, and such errors may work against your favour in applying for a job.

The Emotional Stress

Credit report mistakes can be stressful to handle and a waste of your valuable time. Moreover, such inaccuracies can make one feel a little worried, especially if they affect the approval of vital financial products.

Table 3: Financial Consequences of Credit Report Errors

| Consequence | Description |

| Higher Interest Rates | Errors can lower your credit score, leading to higher borrowing costs. |

| Denial of Credit Applications | Lenders may reject your applications based on inaccurate information. |

| Lower Credit Limits | Errors can result in lower credit limits, reducing your borrowing power. |

| Increased Insurance Premiums | Some insurers use credit information to set premiums, and errors can raise costs. |

| Job Application Rejections | Some employers check credit reports, and errors can affect employment opportunities. |

Case Studies of Credit Report Mistakes

Case Study 1: Incorrect Personal Information

John Smith discovers an incorrect address listed in his credit report. This has caused him a lot of problems in trying to get a mortgage. He disputes this with the credit bureau, providing the correct address, and voilà. The problem is solved, his credit report updated.

Case Study 2: Fraudulent Accounts

Jane Doe discovered several accounts on her credit report that didn’t seem familiar. Thinking that this could be identity theft, she contacted the credit bureaus to dispute the accounts. She provided the police report and an identity theft affidavit, which were enough to have the fraudulent accounts deleted.

Case Study 3: Mixed Files

David Brown discovered someone else’s similar name was listed in his credit report, along with the inquiries. He disputed the error with the credit bureaus and provided proof of identification. The credit bureaus updated his report and deleted the errors.

Real Life Examples for Learning

These case studies identify that one should keep a periodic check on the credit report and act immediately in case of errors. You can avoid long-term damages to your credit score by being proactive and taking quick action.

Legal Rights and Resources

Fair Credit Reporting Act FCRA

Fair Credit Reporting Act is the federal statute protecting the rights of people regarding credit reporting. Under FCRA, you have the right to:

• Access your credit report: Free credit reports are available from each of the bureaus once a year.

• Dispute inaccurate information: You are also allowed to dispute incomplete or inaccurate information in your credit report with the credit bureaus.

•Have inaccuracies corrected in a reasonable amount of time: Typically, they are required to investigate disputed claims within 30 days.

•Be notified if information in your report has been used against you: You have the right to know why you were turned down for credit.

Complaint to the Consumer Financial Protection Bureau

If you are unable to solve the dispute with a credit bureau, then you can make a complaint to the Consumer Financial Protection Bureau, CFPB. The CFPB is in a position to assist in the mediation of the dispute to ensure that your rights are protected.

Seek Legal Assistance

If there are huge problems with errors in credit reports, one can consider taking legal actions. Consumer rights attorneys can guide through these dispute processes to ensure protection for the rights of their clients.

Table 4: Legal Resources for Credit Report Disputes

| Resource | Description |

| Fair Credit Reporting Act (FCRA) | Federal law protecting your rights regarding credit reporting. |

| Consumer Financial Protection Bureau (CFPB) | Federal agency assisting with credit report disputes and protecting consumer rights. |

| National Consumer Law Center (NCLC) | Provides legal resources and assistance for consumer protection issues. |

Tools and Resources for Managing Credit Report Errors

Credit Monitoring Services

Credit monitoring will let you know when changes come up on your credit report. In that respect, such a service would allow you to find out, at the very first sign of an error, that there is something you should investigate. Some popular services include:

• Credit Karma: Free credit monitoring and alerts.

• Experian Credit Works: Paid service with extra features, like identity theft protection.

• Identity Guard: Comprehensive identity theft protection and credit monitoring.

Free Annual Credit Reports

Remember, under federal law you can request one free credit report from each of the big three once a year free at AnnualCreditReport.com. It’s a good idea to check them regularly to try and catch errors sooner rather than later.

Credit Counseling Services

Non-profit credit counseling services will also consult with you about your credit and how to dispute errors. Most have free or low cost services available and can help you make a plan to become more creditworthy.

Table 5: Useful Resources for Managing Credit Report Errors

| Resource | Description |

| AnnualCreditReport.com | Obtain free credit reports from Equifax, Experian, and TransUnion annually. |

| Credit Karma | Free credit monitoring and alerts. |

| Experian Credit Works | Paid service with identity theft protection and credit monitoring. |

| Identity Guard | Comprehensive identity theft protection and credit monitoring. |

| Consumer Financial Protection Bureau (CFPB) | Federal agency that assists with credit report disputes and protects consumer rights. |

| Non-Profit Credit Counseling | Organizations that provide free or low-cost credit counseling and dispute assistance. |

Credit Report Dispute Checklist

The following steps are offered as a checklist to make the dispute process as smooth and effective as possible:

1. Get your free reports from Equifax, Experian, and TransUnion.

2. Point out mistakes in your personal information, the accounts you own, and in the inquiries.

3. Gather Evidence: Start gathering statements of accounts and payment receipts.

4. File the dispute: You can do this either online or by mail to the credit bureau reporting the error.

5. Follow up: Check regularly on the status of your dispute and the corrections done accordingly.

6. Monitor your credit: Keep checking on your credit reports to be aware of errors way ahead of time.

How to Build a Good Case for Your Dispute

While one disputes errors on the credit report, it is of paramount importance to build a good case. Some of the tips are as under:

• Be Specific: Clearly state the errors and point out why they are wrong.

• Provide Proof: Attach duplicated copies of documents used in support of your claim.

• Record Keeping: Keep a record of every single correspondence involving your dispute.

• Persistency: Do follow-ups regularly. Escalate the dispute if necessary.

FAQs

How often should I check my credit report?

You are entitled to request your credit report once a year from each of the three major credit bureaus. The more often you are able to monitor, the better chance you have at catching mistakes early on and that all your information is correct.

What if I find an error on my credit report?

If you’ve found an error on your credit report, include supporting documentation and submit a dispute to the credit bureau that’s reporting it. Follow up to make sure it gets fixed.

How long does it take to resolve a credit report dispute?

The credit bureaus will likely have 30 days to investigate and then respond to your dispute. In case more information is needed, this might take a little longer.

Will disputing errors hurt my credit score?

No, disputing errors in your credit report will not hurt your credit score. Correcting the mistakes can improve your score by ensuring that accurate information goes into your reports.

What if a credit bureau rejects my dispute?

If a credit bureau turns down your dispute, you are allowed to include in the credit report a statement of dispute. You are also at liberty to file a complaint with Consumer Protection Financial Bureau or seek other legal assistance.

How do I protect myself against Identity theft?

This can be avoided by checking on your credit on a regular basis, with identity theft protection services, and by being very cautious with your information. This can further be prevented by freezing the reports so that no unauthorized accounts can be opened in your name.

Is there any fee for challenging errors on the credit reports?

No, there is no cost to dispute credit report mistakes. You can do it for free online, by mail, or over the phone with the credit bureaus.

What is a credit freeze, and how do I request one?

A credit freeze restricts anyone’s ability to view your credit report, making it much harder for identity thieves to open new accounts in your name. You can request a free credit freeze from each of the three major credit bureaus: Equifax, Experian, and TransUnion.

Am I able to dispute mistakes on my credit report without supporting documentation?

While one can dispute errors without supporting documents, your case becomes much stronger and more likely to succeed if you have the documents backing up your claim. Therefore, it is best to include the documents that would help support your claim.

How can I improve my credit score after correcting errors?

Once errors are removed from your credit report, develop good credit by never paying late, reducing debt, and not seeking new credit. Check your credit often to help ensure a healthy credit profile.

Conclusion

You can also make use of these steps and the resources available to fight back in 2024. An error-free credit report is the crux of having a healthy, robust financial life that ensures protection of your creditworthiness. Keep vigil, check your credit regularly, and take immediate remedial actions whenever you spot an error to ensure a safe financial future.

Summary of Key Points:

1. Free Credit Reports: Download free reports from Equifax, Experian, and TransUnion.

2. Go Through the Reports: Check error scores against personal information, accounts, and inquiries.

3. Evidence Documented: Do collect evidence in the form of account statements and payment receipts.

4. File a Dispute: An online dispute can be submitted or via mail to the credit bureau that is reporting the error.

5. Follow-up: The credit bureau is verifying your dispute and making the proper corrections.

6. Protect Your Credit—Check on your credit often, freeze your credit, and use identity theft protection services.

Be really, really vigilant, proactive, and error-free in keeping your credit report in order to help you protect your financial health in 2024 and moving forward.k you.

3 thoughts on “How to Fight Back Against Credit Report Errors in 2024”