Citizens Bank and Trust Online: The banking industry is in the midst of a digital transformation that gives consumers more power to manage their money than ever before. No longer would anyone have to wait in line at the bank or balance their checkbooks manually. Online banking is one of the indispensable tools for individuals and businesses in this modern era of convenience.

Citizens Bank & Trust, an independent Community-focused bank that offers expansive digital capabilities, is one financial institution blazing this trail. These include the Citizens Bank and Trust online banking service which offers a convenient, powerful manager of financial transactions at home or on the go.

What is Citizens Bank and Trust Online Banking

Citizens Bank and Trust online banking is an internet-based service provided by Citizens Bank & Trust that enables customers to carry out most of their banking in the comfort of their home, office, or on the move. Users to do their accounts, pay bills, transfer funds, and monitor transactions on a desktop without taking up space in a branch. It is poised to provide convenience, freedom, and security for personal and business banking requirements.

Citizens Bank and Trust Online Banking Features

With Citizens Bank and Trust online banking, there is an array of features to help users manage their finances easier. More insight into what the platform provides:

1. Account Management

Basic Instant Access with Citizens Bank and Trust online banking See account balances live, review transaction histories, and watch over changes to your accounts across multiple account types. This option is ideal for people who want to keep an eye on their money and identify any errors or unauthorized transactions as soon as possible.

2. Bill Pay

Man Bill Pay simply makes bill paying easier. One-time or recurring payments for service providers, creditors, and utilities can be done through Citizens Bank and Trust online banking itself. It is a convenient way to pay bills when you need them (e.g., monthly or quarterly), without the risk of writing checks or mailing payments, so that there are no missed due dates. Automatic payments are great for bills you pay every month, like rent, mortgage, or utilities since they keep the amount consistent and help prevent late fees.

3. Funds Transfer

Transferring money between accounts is one of the most important features that you will want to be able to use with online banking services. Moving money between your accounts, paying others, or getting money should be painless with Citizens Bank online banking. It also lets you program future transfers, and recurring ones to save or automatically repay your loan in the image of your debts.

4. Mobile Banking App

If you require a more mobile approach to financial management Citizens Bank and Trust also offers an integrated mobile app as well. The app gives all the same capabilities as the full desktop site from checking your account balance to paying bills or transferring funds, on a smartphone or tablet. As an iOS and Android-compatible app, the banking services are available to you around the clock, right at your fingertip.

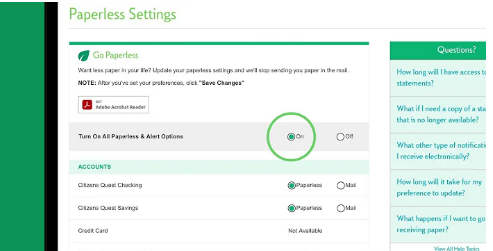

5. eStatements

Not only is it better for the environment to go paperless, but it´s also extremely convenient. Customers can also sign up for eStatements from online banking with Citizens Bank and Trust which means their bank statements in digital form. Users can access these documents anytime through the platform, which enables them to avail their financial information well before their paper statements would arrive in the physical mail.

6. Alerts and Notifications

Keeping up with changes in your account is important use customizable alerts and notifications from Citizens Bank and Trust online banking to take care of it. Customers can track events including low balances, large transactions, or upcoming bill payments, and set alerts to keep tabs on these. They can be sent as an alert to your email inbox or SMS notification, so you never miss out on learning what’s happening with your account.

7. Business Banking Tools

Citizens Bank and Trust online banking also offer features specific to business owners. Business banking clients can perform wire transfers, Automated Clearing House (ACH) transactions for payroll and other professional purposes, and cash flow management services. It also provides merchant services for businesses to get access to a more fluid and secure payment process.

Citizens Bank and Trust Online Banking Security

In terms of online banking, security is the key. Citizens Bank and Trust have multiple features in place to protect your financial information and to ensure that our online service is as safe and secure as possible.

1. 2- Multi-Factor Authentication (MFA)

Multifactor Authentication (MFA) Citizens Bank and Trust utilizes MFA for online banking to prevent unauthorized access. It is an added security that asks you to prove your identity two or more ways before being able to get into your account (a password and a unique code sent to your phone, for example). MFA provides the user with that added layer of defense which makes it much more difficult (though not impossible) for unauthorized users to access your financial information.

2. Encryption Technology

All transactions performed on the Citizens Bank and Trust online banking site are encrypted with 128-bit encryption(validation). This means that all your private data like account numbers and personal info stay away from the reach of hackers and other ill-intentioned agents. Protecting your data encryption in transit between your device and the bank’s servers

3. Automatic Logout

As a security enhancement, Citizens Bank and Trust online banking will automatically log users out of online banking if they are inactive for this period. Secure Email Delivery – This feature ensures that someone else cannot access your account if you forget to log out of a session.

4. Fraud Detection Systems

Citizens Bank and Trust is equipped with strong fraud detection protocols that protect accounts from unauthorized activity. The bank may alert you right away if it thinks there are any unusual transactions and will place a hold on those flagged transactions for human review. That proactive approach is assisting to lessen the danger of fraud and identification robbery.

5. Security Alerts

Customers, for example, can configure security alerts to alert them of general activities associated with key accounts such as changes to login credentials and large withdrawals; and the addition of new payee addresses. That way users can act fast as soon as suspicious activity is detected.

Conclusion

In a world of growing digital convenience, Citizens Bank and Trust online banking provides a complete solution to controlling your finances securely and simply. Opening a deposit account, transferring money, and paying bills are all done in real-time or less and the platform offers enhanced security features for both personal and business banking.